Unlock $50K–$250K in 0% Business CreditThen Scale with Strategic Bankable Capital

We help startups & established business owners with 700+ Credit Structure their businesses, Optimize their credit & Access 0% capital. Even if you’re just getting started or you’ve been denied before by banks.

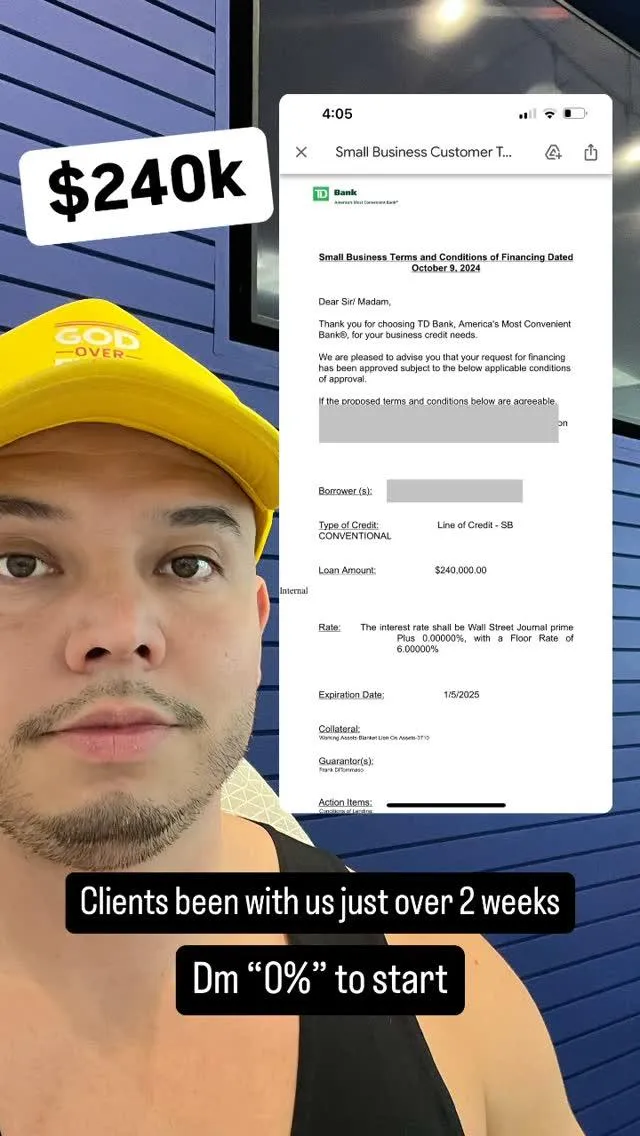

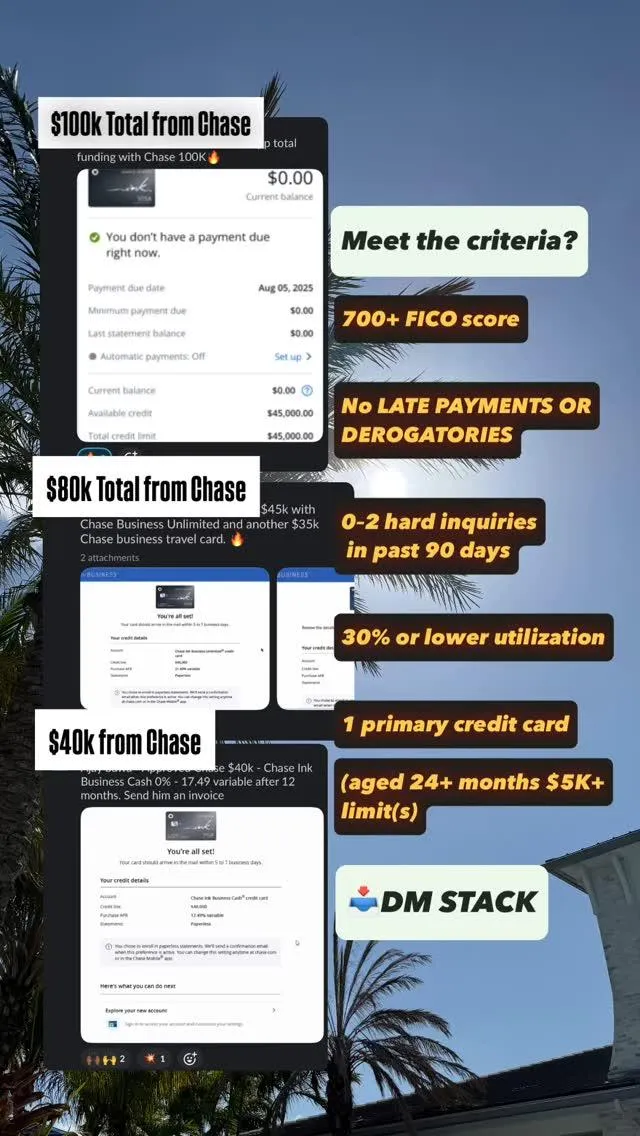

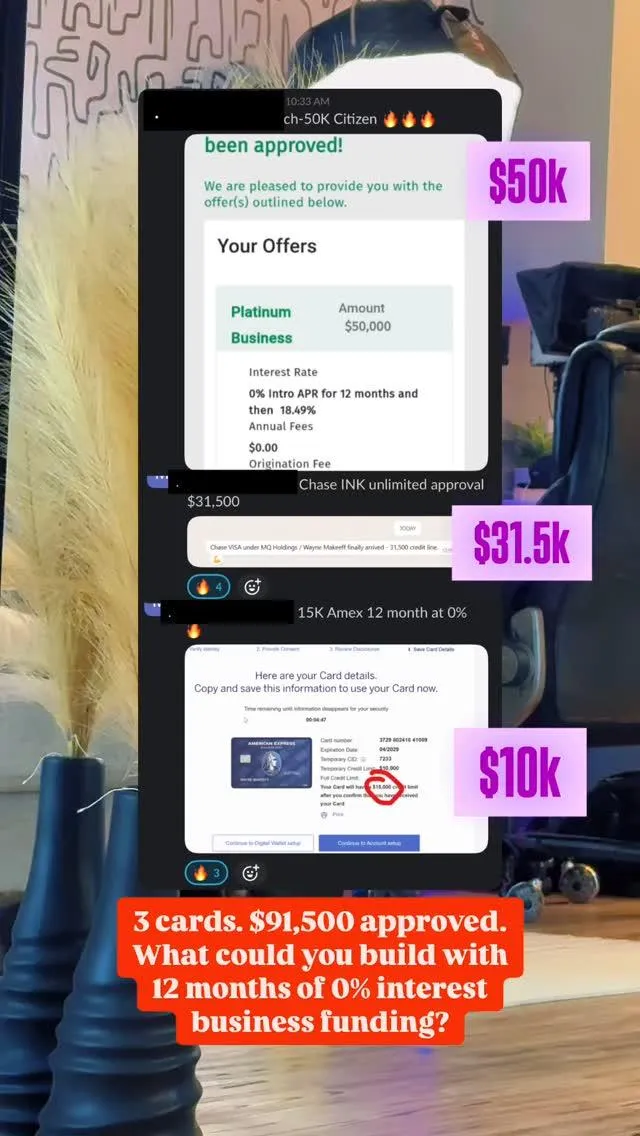

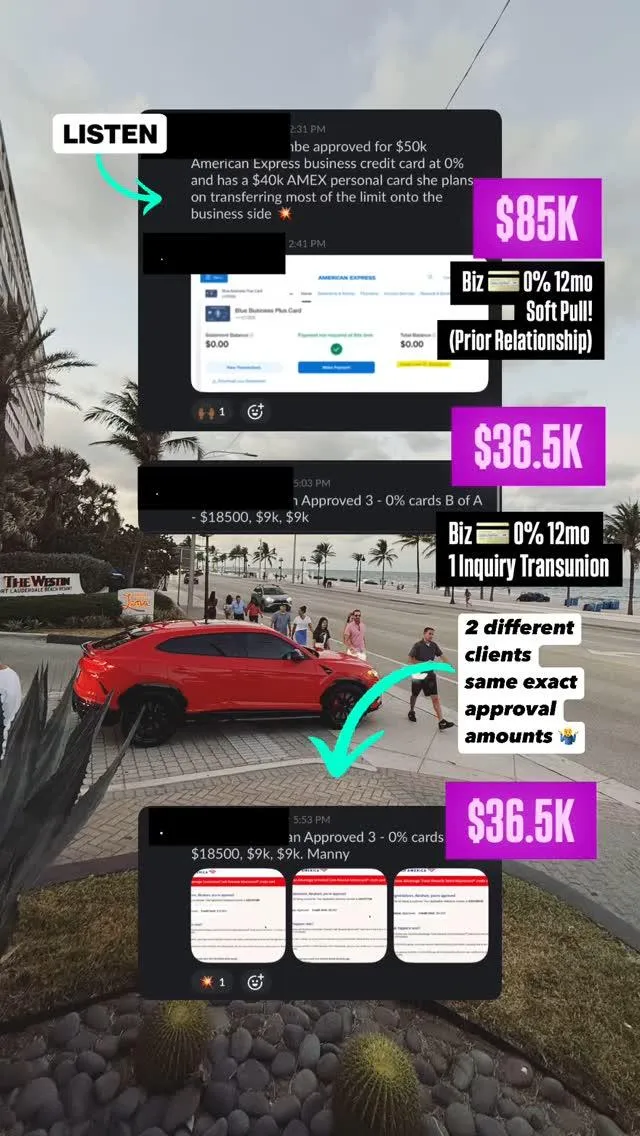

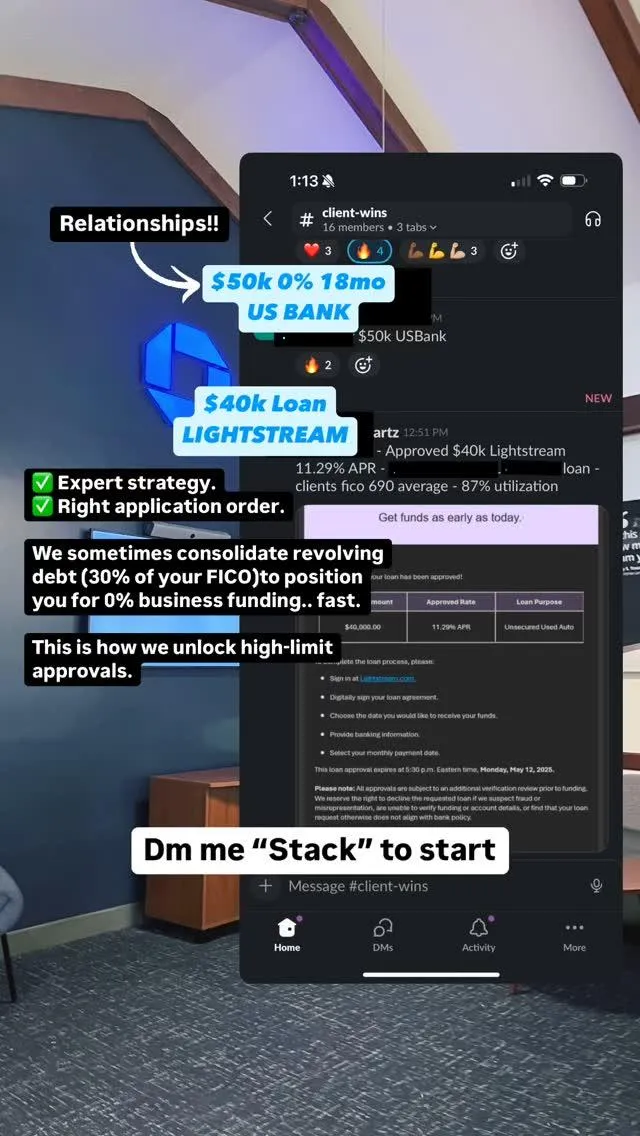

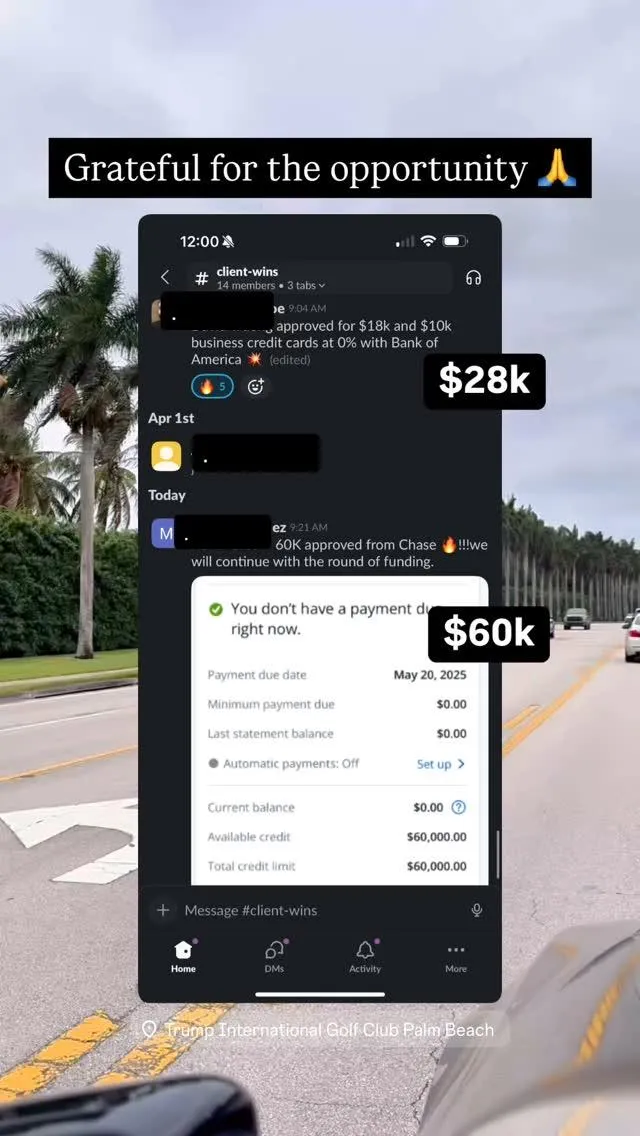

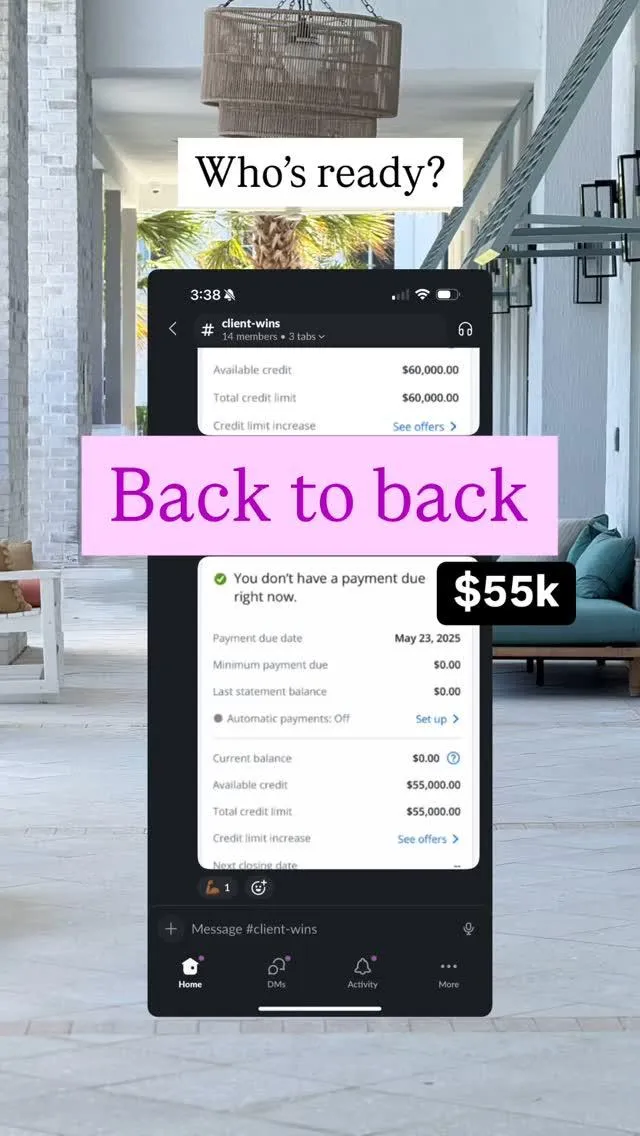

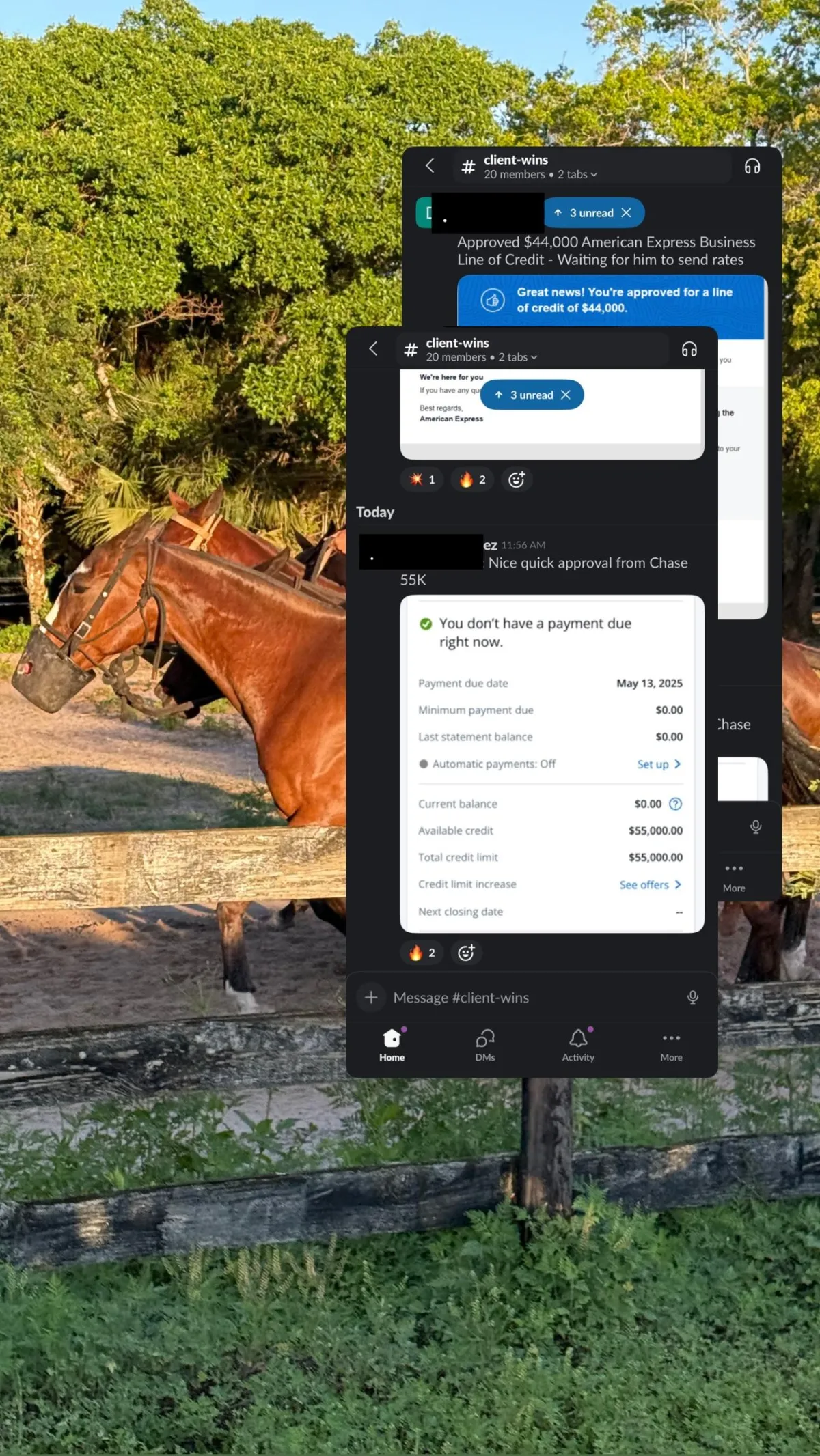

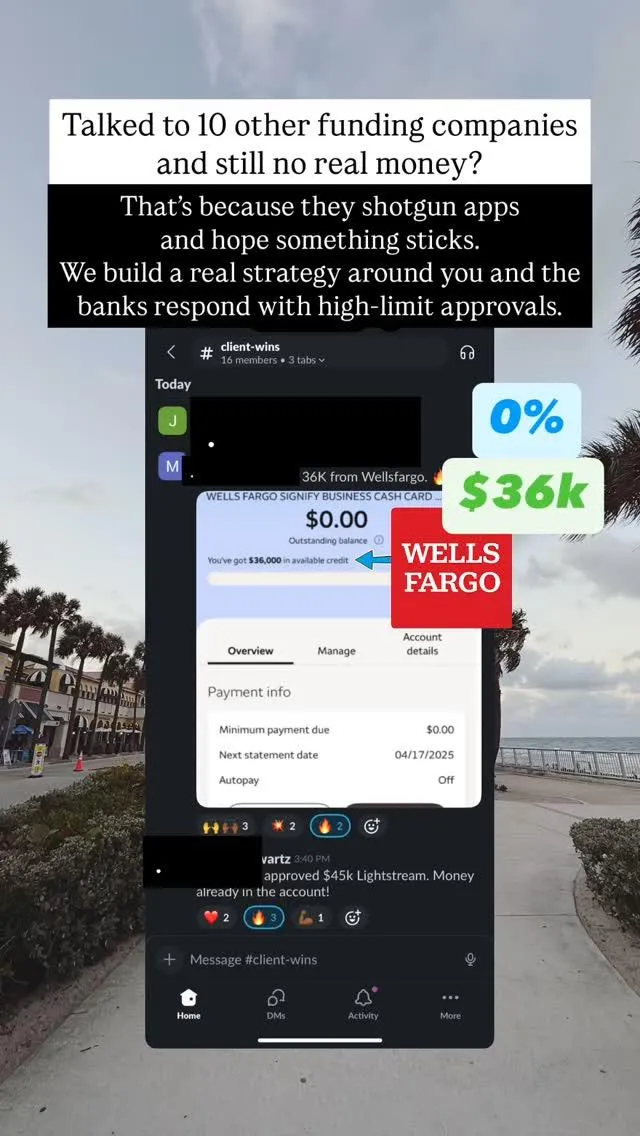

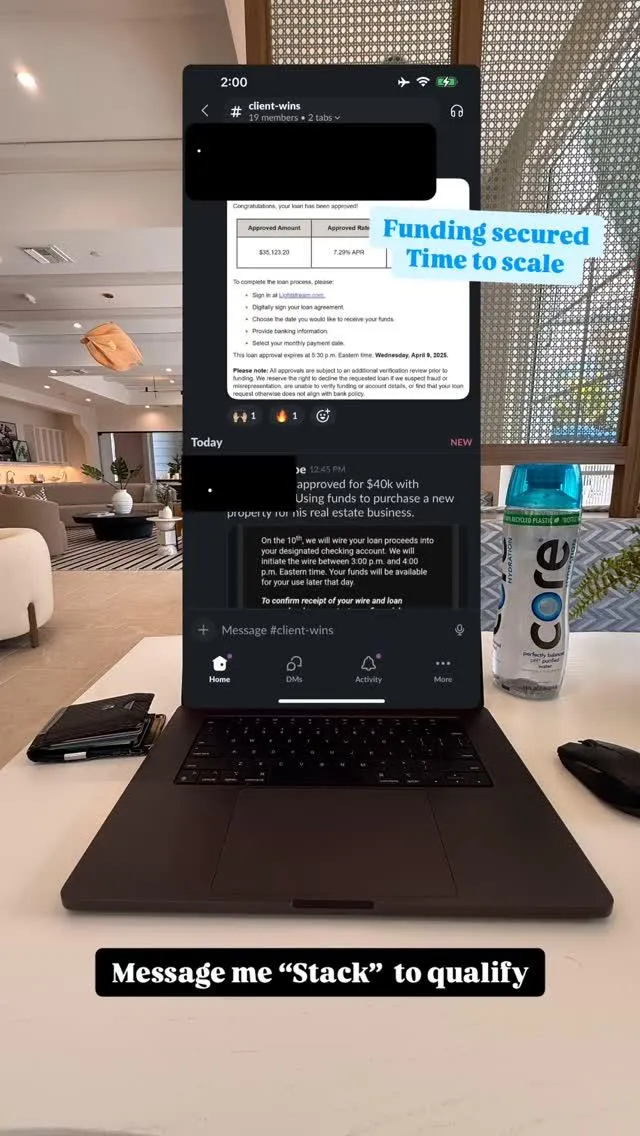

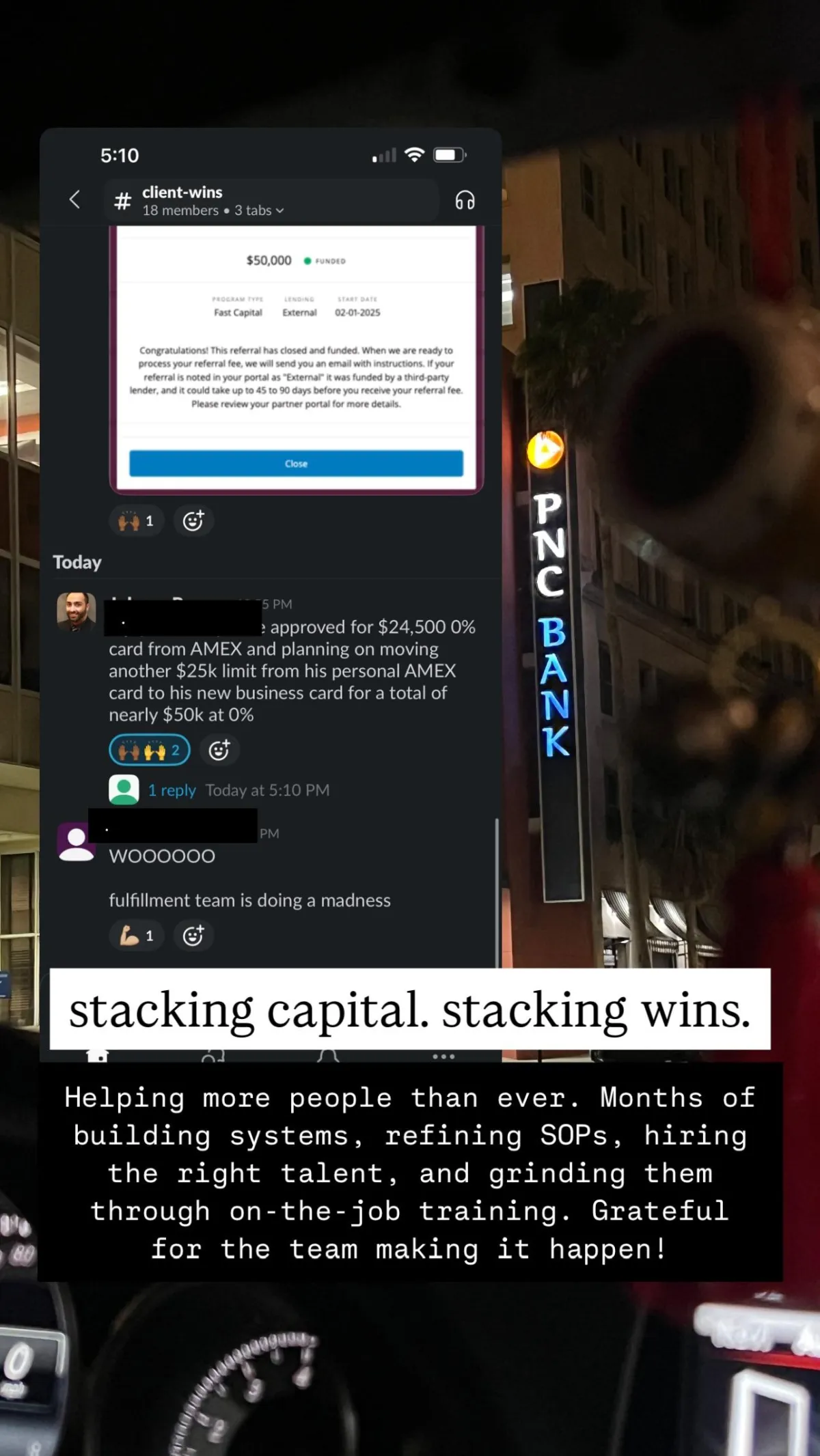

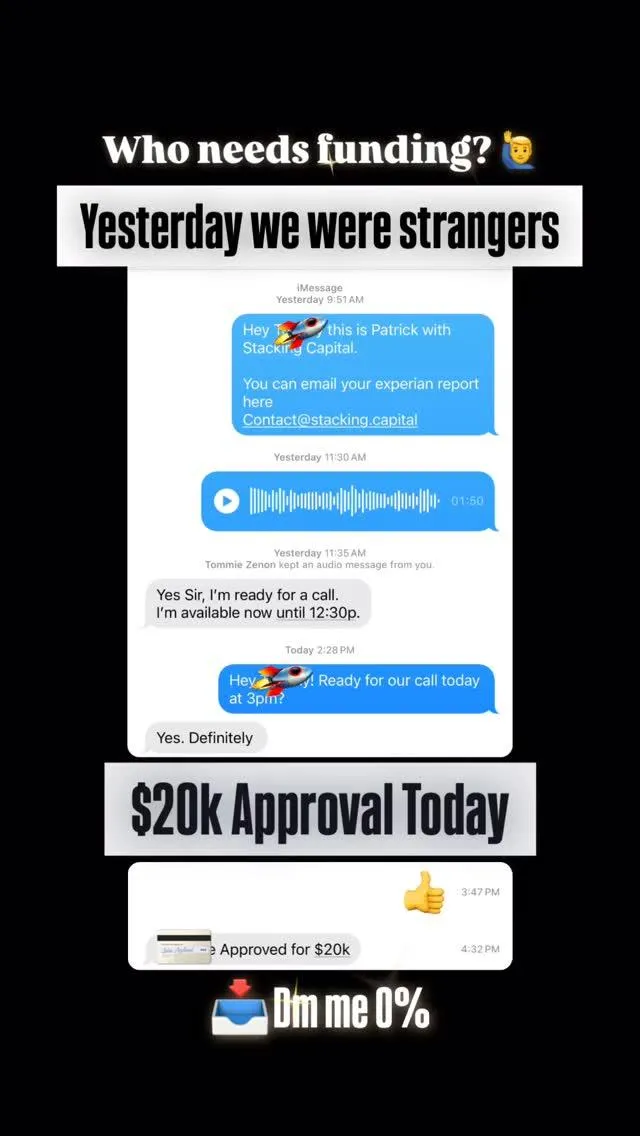

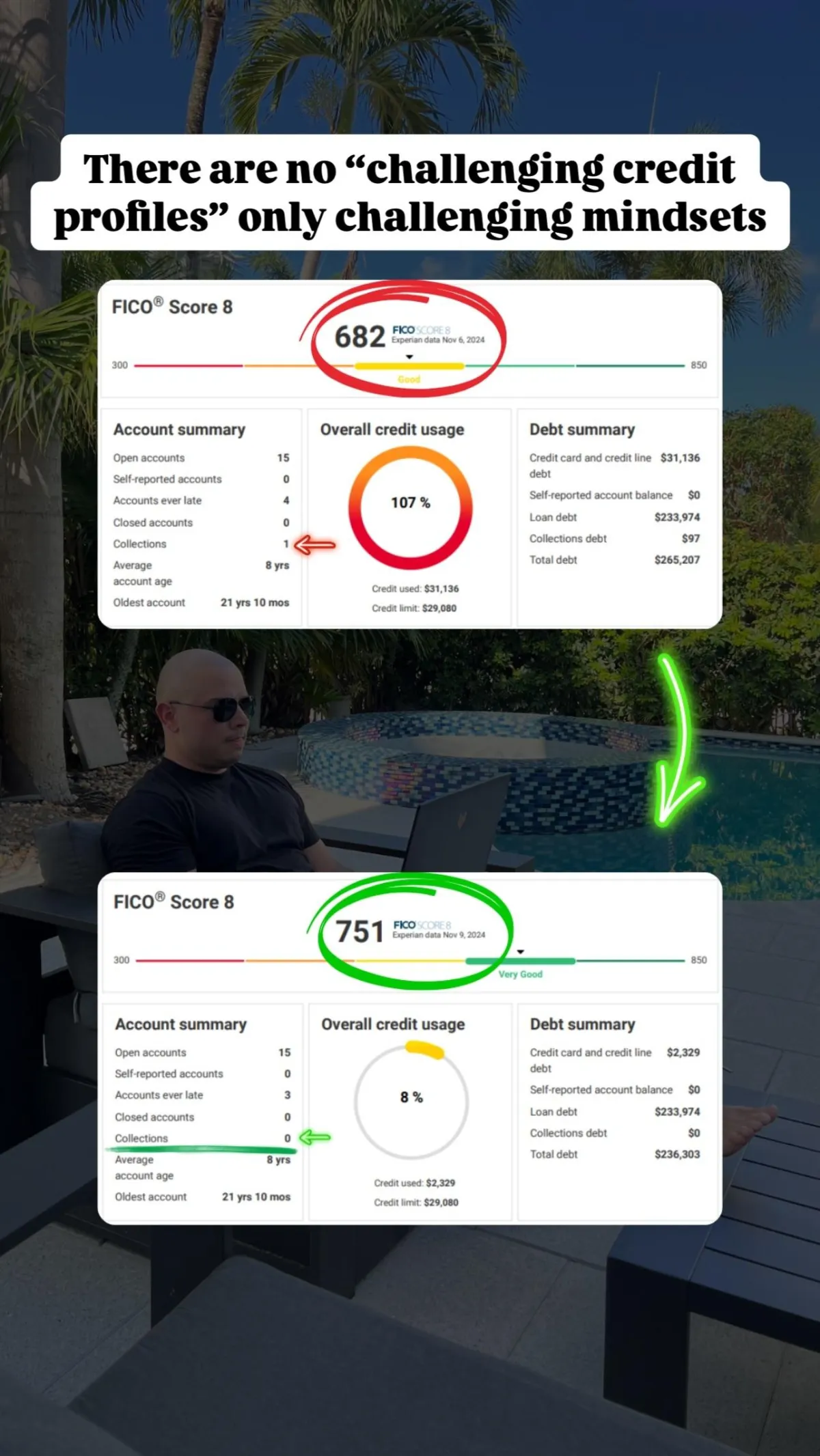

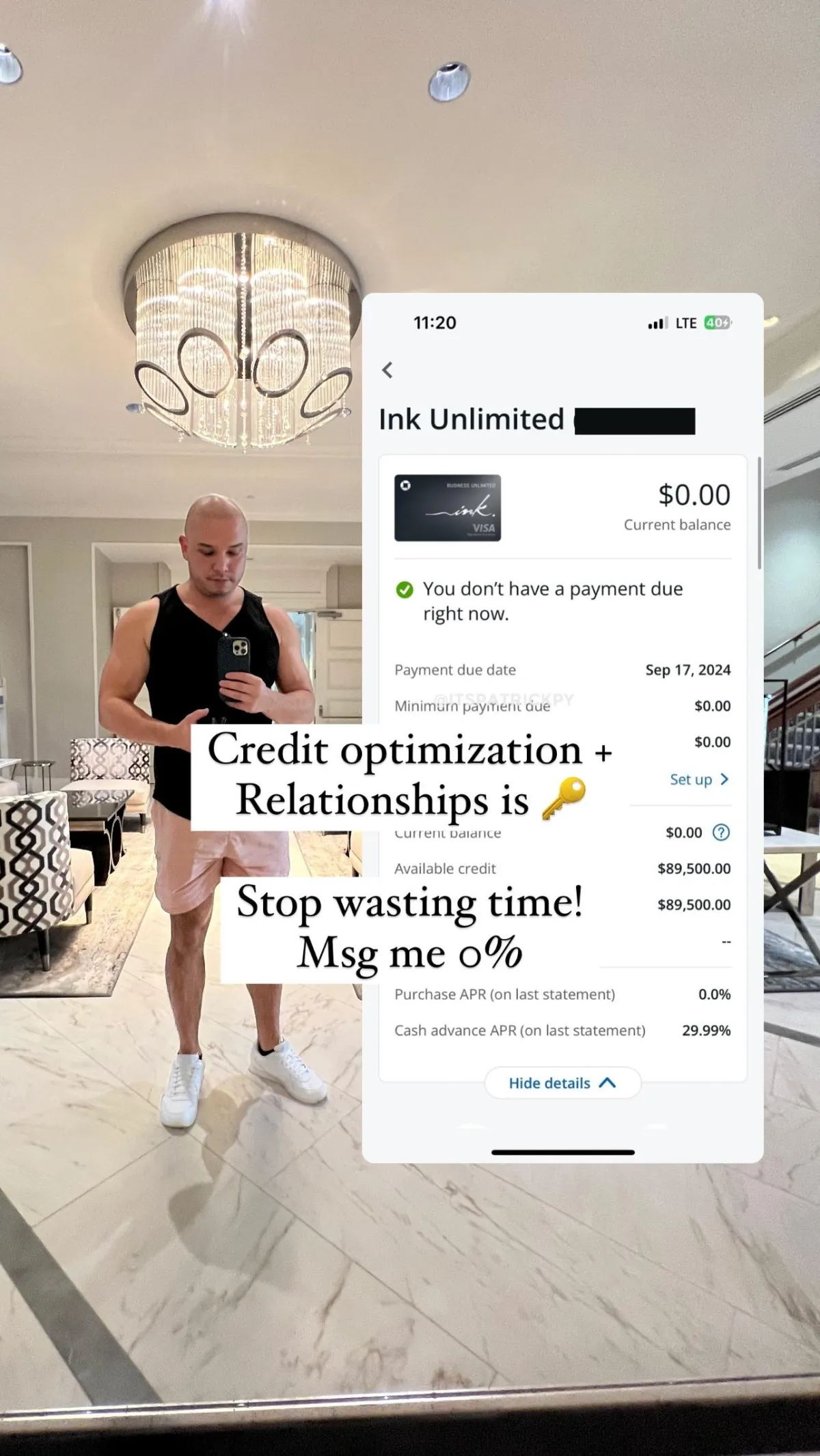

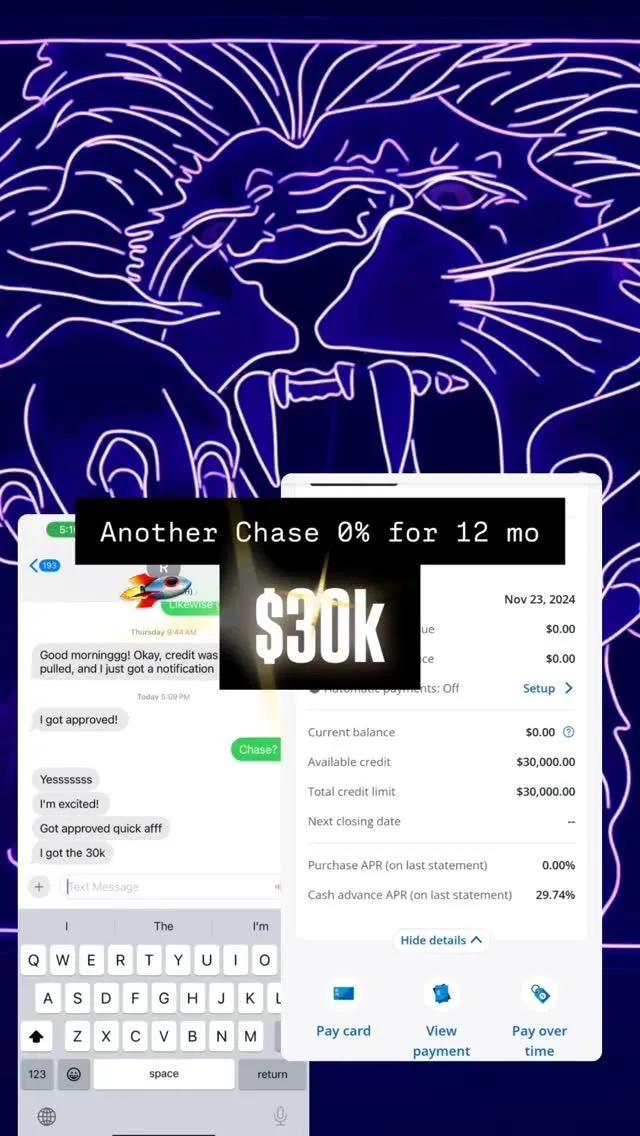

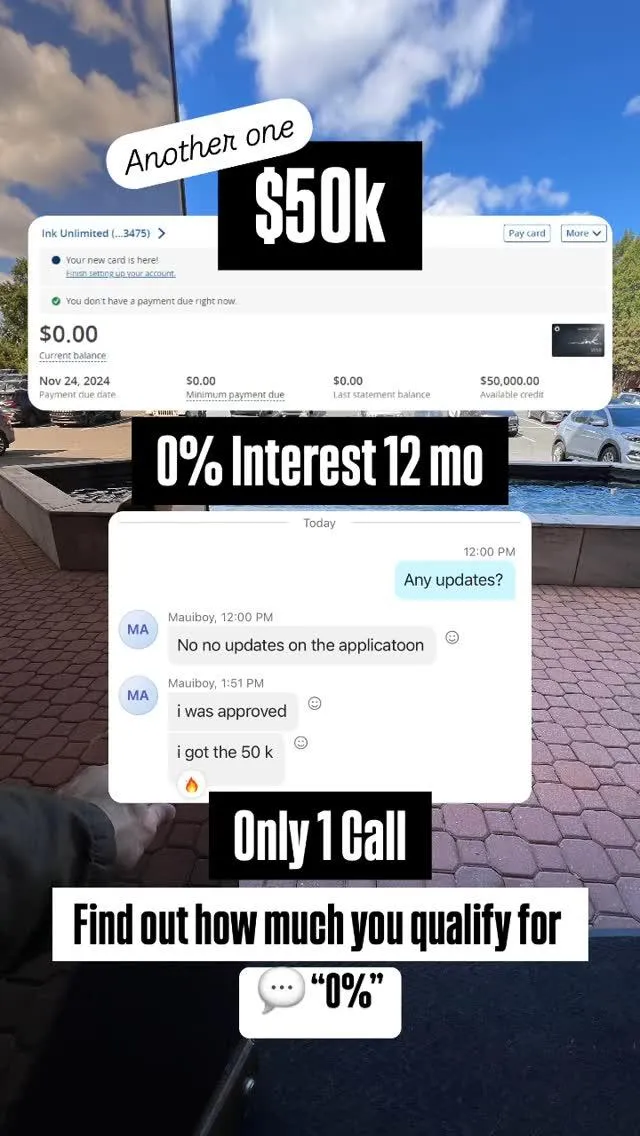

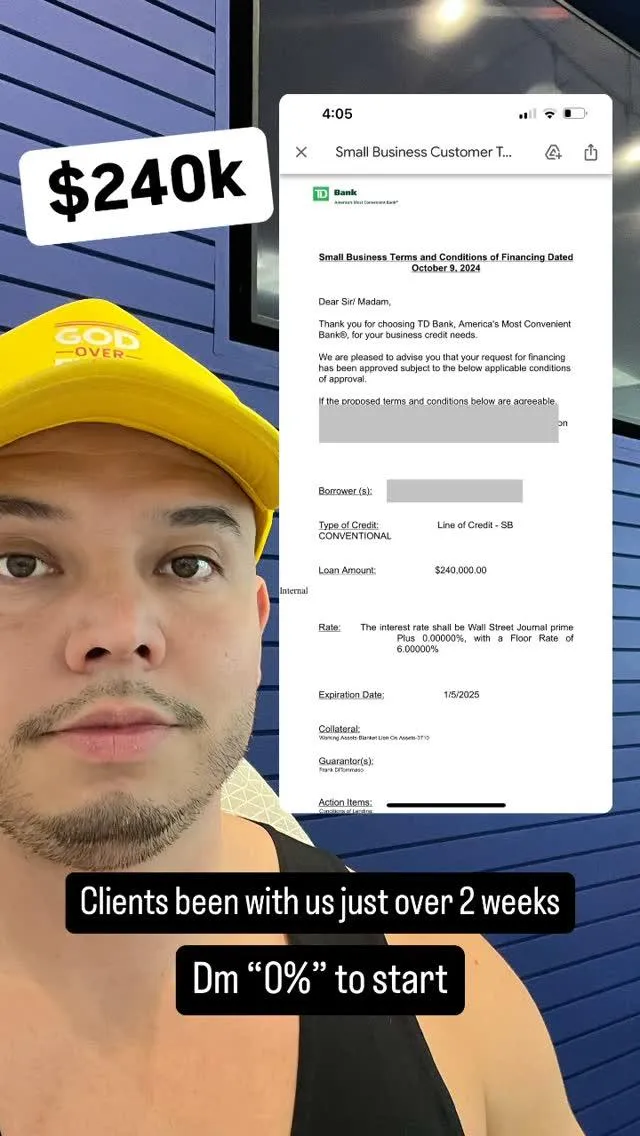

RESULTS

Real Results from Real Clients

“$164K Approved. 0% Interest. Game Changer.”

“Other companies couldn’t get me results, but Patrick’s team got me $164,000 in approvals at 0% interest—in just 60 days. As a physician, I needed someone to guide me. They did it all for me, start to finish.” - Dr. Truong

“From 20 Bank Rejections to $175K Approved”

“I was denied by every lender until I found Patrick’s team. They got me $175,000 at 0%. Just strategy and fast results. Now I have the capital to launch my dream.” - Brandy, Medspa Owner

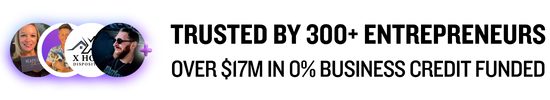

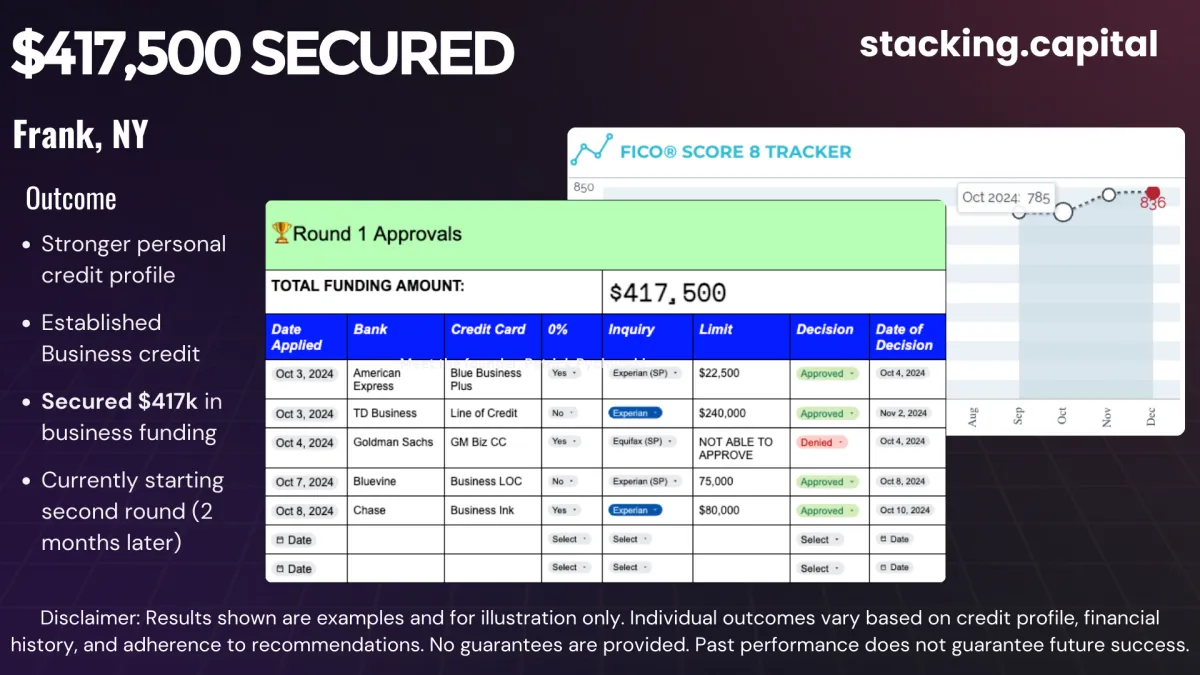

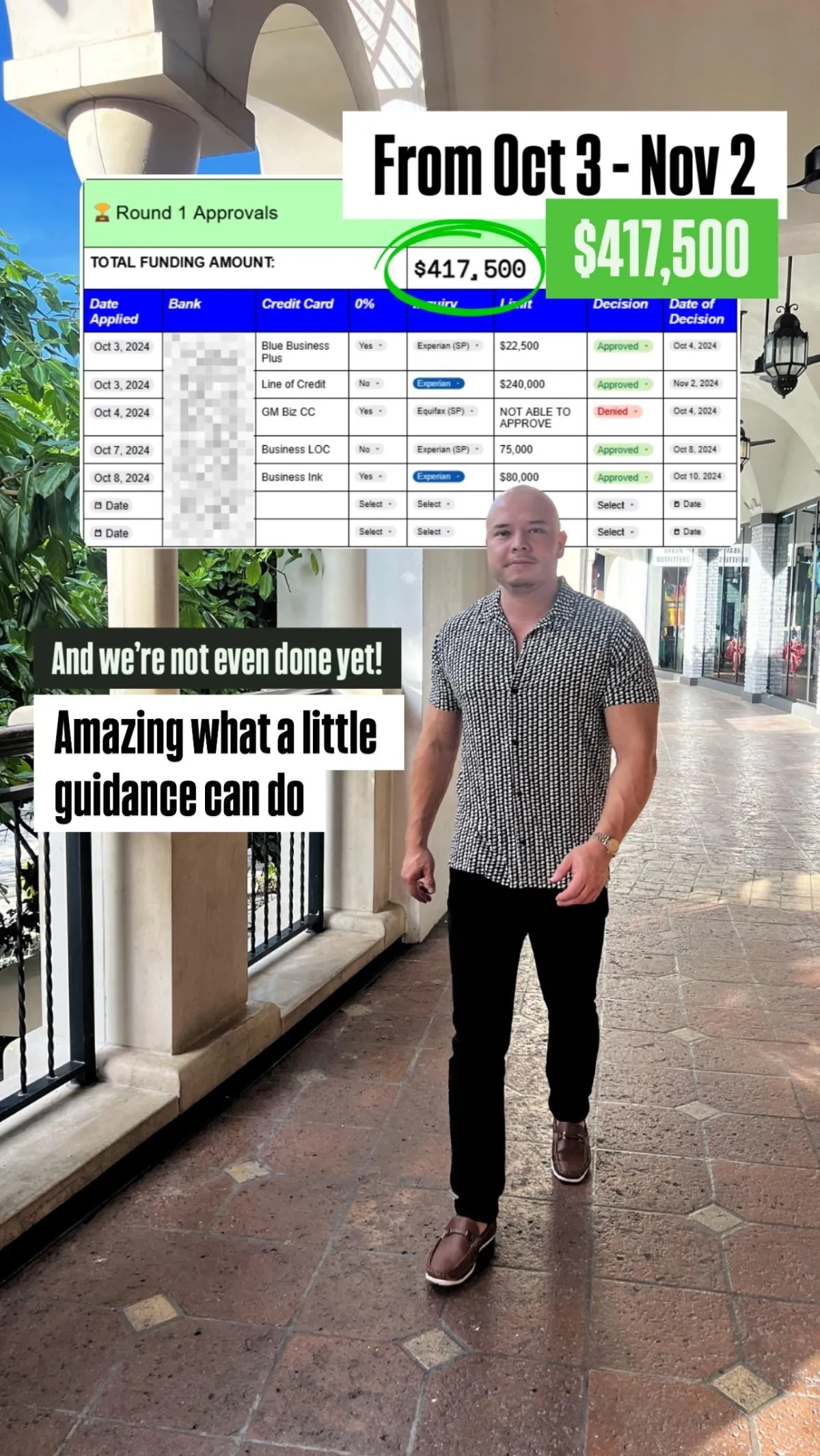

"Stacking Capital secured $417,000 of low interest capital in about 30 days"

"I've been in real estate for over 20 years, I've missed out on opportunnities because I didnt have access to low interest capital. I just followed their step by step process thanks to the team at Stacking Capital" -Frank, REI/Broker

“Best financial move I ever made.”

“I went from no direction to $45,000 in business funding, fast. The patience, integrity, and hands-on guidance made all the difference. I wouldn’t trade this for a million bucks.” – Erwin, CA

PATRICK PYCHYNSKI, STACKING CAPITAL

From U.S. Marine to 8-Figure Business Funding Expert

Patrick Pychynski, Founder of Stacking Capital

The go-to expert for entrepreneurs who want to unlock massive 0% interest funding without drowning in high interest debt.

He helps established business owners secure $50,000 to $500,000 in funding so they can scale without risking their hard earned savings or giving up equity or collateral.

After discovering untapped credit opportunities during the pandemic, Patrick invested over $50,000 mastering the funding game.

His Stacking Capital Strategy has helped secure over $17 million in 0% business credit alone for 300+business owners.

His unique approach combines Marine Corps discipline with relationship banking to get entrepreneurs funded in as little as 14 days.

In a world where most business owners get trapped by predatory lenders, Patrick takes a different approach.

Instead of pushing quick-fix loans, he helps clients build long-term banking relationships that unlock true business freedom

His mission is helping ambitious entrepreneurs access the capital they need while protecting their personal credit.

Patrick Pychynski, Founder of Stacking Capital

The go-to expert for entrepreneurs who want to unlock massive 0% interest funding without drowning in high interest debt.

He helps established business owners secure $50,000 to $500,000 in funding so they can scale without risking their hard earned savings or giving up equity or collateral.

After discovering untapped credit opportunities during the pandemic, Patrick invested over $50,000 mastering the funding game.

His Stacking Capital Strategy has helped secure over $17 million in 0% business credit alone for 300+business owners.

His unique approach combines Marine Corps discipline with relationship banking to get entrepreneurs funded in as little as 14 days.

In a world where most business owners get trapped by predatory lenders, Patrick takes a different approach.

Instead of pushing quick-fix loans, he helps clients build long-term banking relationships that unlock true business freedom

His mission is helping ambitious entrepreneurs access the capital they need while protecting their personal credit.

CONNECT WITH ME ON SOCIAL

In the Spotlight

See Your Funding Potential

Calculate your qualification amount instantly

Funding Calculator

Calculate your potential business credit funding

$0 Funding Projection

Based on your current profile, you don't qualify for 0% business credit. Contact us to learn how to improve your qualifications.

MORE RESULTS

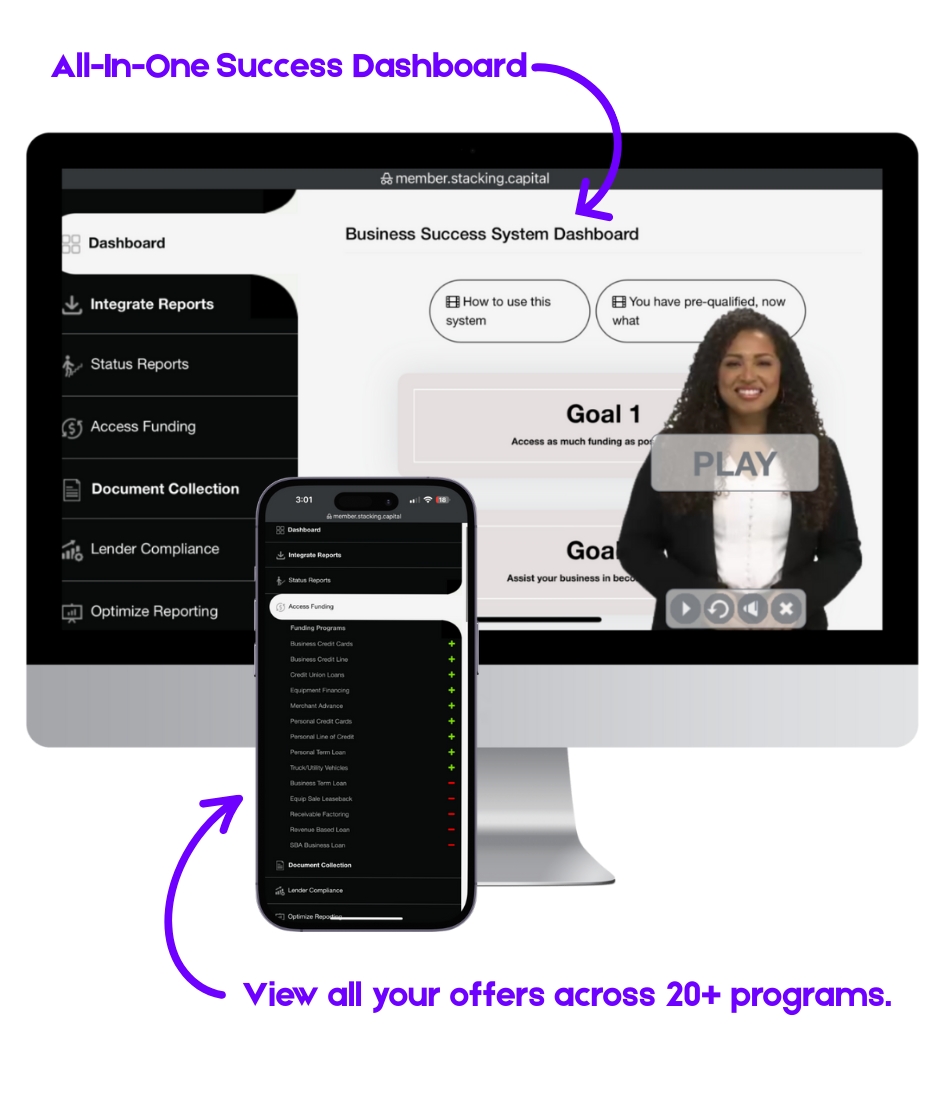

Not Ready TO BOOK a Call?

See What You Qualify For. No HARD PULL, NO COST.

Run a Free Business Success Scan & Unlock Your Funding Options in Minutes

Get your custom funding range report and discover your real options to build, grow, or launch your business.

No hard credit pull

No "sales" call required

Personal info stays private

or

0% Business Credit Card Funding

Frequently Asked Questions

How long does it take to receive the funds?

Once applications are submitted, approvals typically occur within 5–7 business days. Physical cards usually arrive shortly after. If you need to convert your credit line into cash, we can connect you with a trusted partner who can assist with liquidation.

What documents are required to apply?

Our program is primarily stated income, so documentation is minimal. We do require:

-A personal credit score of 700+

-No more than 2–3 new accounts opened in the last 6 months

-No derogatory marks on your credit report

-Credit utilization below 30%

What are the interest rates?

These cards offer introductory 0% interest rates for 9–18 months, depending on the issuer. After the introductory period, standard variable rates apply.

Can this process be repeated?

Yes — in fact, we design it to be. With proper preparation, this strategy can be repeated every 60 to 90 days for new rounds of 0% interest business credit.

Here’s how it works:

Inquiry Removal:

-Experian inquiries can often be removed within 7 business days

-Equifax & TransUnion may take up to 60 days

While that’s in progress, we’re already optimizing your profile for the next round to ensure high-limit approvals.

That means by the time your inquiries are cleared and your profile is ready, we’re positioned to strike again. And long-term?

If your 0% interest period is set to expire, we can plan ahead to stack a new round of 0% credit — allowing you to roll into fresh capital and keep growing without paying interest.

We’ve even helped clients go back to the same bank, round after round, but the key is:

-Perfect payment history

-Utilization kept below 45% (when applying)

-Ongoing prep and strategy

Bottom line:Yes, this process is repeatable — and if done right, we’ll guide you every step of the way to help you secure 0% interest capital again and again.

Is it possible to secure $180,000 in funding?

Yes, it’s absolutely possible but it comes down to how you’re positioned. We specialize in stacking multiple business credit cards and, in some cases, combining them with revenue-based lines of credit (for businesses doing $10K+/mo and operating for at least 1 year).

That said, it’s not just about having a good credit score. What really matters is the credit report, specifically:

Comparable credit: Having a track record of responsible usage on high-limit accounts.

Credit age: The longer the history, the stronger your profile.

Personal utilization & inquiries: The fewer, the better. We’ve helped clients hit $100K–$250K+ in a single round by structuring things the right way. If your profile supports it, $180K is definitely within reach.

Are there cash advance fees?

If you choose to liquidate your credit line into cash, our partners typically charge a fee of around 6%. This method allows you to access funds without incurring standard cash advance fees (25%+ APR) and retains your 0% interest period.

Will the money be deposited into my bank account?

These are business credit cards, not traditional loans. However, if you need cash, our partners can help liquidate the credit line (tax deductible expense) into your bank account, allowing you to retain your 0% introductory interest period.

How does repayment work?

As with typical credit cards, you're required to make monthly minimum payments, usually 1–2% of the balance. You're only paying interest on the amount you use.

What are the terms of the credit lines?

These are revolving lines of credit, not term loans. You can use and repay funds as needed, and with responsible usage, your credit limits may increase over time.

Are there any fees for early repayment on business credit cards/lines?

No. In fact, paying off your balance early and maintaining low utilization can positively impact your credit profile and may lead to higher credit limits in the future.

Do business credit cards report to personal credit?

Roughly 95% of true business credit cards do not report to your personal credit as long as they remain in good standing. That means your utilization won’t tank your personal score, which is a major advantage when building long-term leverage.

Why should I do this now instead of waiting?

Because waiting costs you. And… the funding game is shifting — fast. Right now, banks are tightening up. 0% offers that used to be 12–18 months are getting slashed to 6–9.

Banks are tightening approvals and once your credit profile gets overexposed, it can take months to fix. But the real reason to move now? The more prepared your file is, the higher your limits and the better your funding outcomes.

And here’s what makes us different: We don’t stop at 0% business credit. That’s just the beginning.

We’ve helped hundreds of clients secure $50K–$250K in 0% capital but that’s Phase 1. We also offer advanced consulting programs for those who want to go further:

-Become fully bankable

-Unlock $500K–$5M in long-term, low-interest funding

-Qualify for lines of credit that don’t require personal guarantees

Why can’t I just do it myself?

Look, we get it. There’s a lot of advice out there. YouTube videos, $8K courses, free guides. We’ve seen it all. In fact, we’ve been through it ourselves. But here’s the reality most people find out after wasting time and money:

Much of the advice out there is outdated, incomplete, or flat-out wrong.

Funding isn’t just about having a 780 credit score.

We’ve seen clients with “perfect credit” get denied across the board — and the issue? A P.O. Box listed on their Experian business credit profile.

That one detail shut them down with every major lender. No YouTube video covered that.

We’ve built a proven system not just to get approvals, but to avoid the hidden landmines that sink most applications.

And that’s the difference:

We don’t just show you how to get 0% cards.

We tailor the strategy based on your exact credit + business profile

We do it with real underwriting insight, not generic advice

You get direct one-on-one guidance to navigate the process, not a DIY checklist

If you want real results, you need real strategy. That’s what we do — and we do it right.

© 2025 Stacking Capital. All rights reserved.

This site is not a part of the Facebook™ website or Facebook™ Inc., nor is it endorsed by Facebook™ in any way. Facebook™ is a trademark of Facebook™, Inc.

This website and its content may reference financial results or client testimonials. Results are not typical and will vary based on effort, creditworthiness, and external factors.

By using this site, you agree to our Terms & Conditions, Privacy Policy, Important Disclosures, Earnings Disclaimer, Refund Policy, and Cookie Policy.